From The Helm

January 2026

Looking to 2026:

The Only Certainty Is Change

Published January 14, 2026

After a turbulent start marked by tariff concerns following Liberation Day, 2025 delivered robust gains across financial markets – reinforcing the value of staying the course and remaining invested through uncertainty. US equities (as measured by the S&P 500) returned 17.9% in 2025, while international equities (as measured by the MSCI ACWI ex US) returned 33.1% in US dollar terms. Fixed income markets also performed well, with the Bloomberg US Aggregate up 7.3%, a rare performance during a strong equity bull market. Our strategies largely outperformed benchmarks, with our alternative’s portfolio returning 33.9%, driven by gold and uranium positions. These results underscore continued success for our clients in 2025.

Strong Earnings Growth: The Dominant Theme

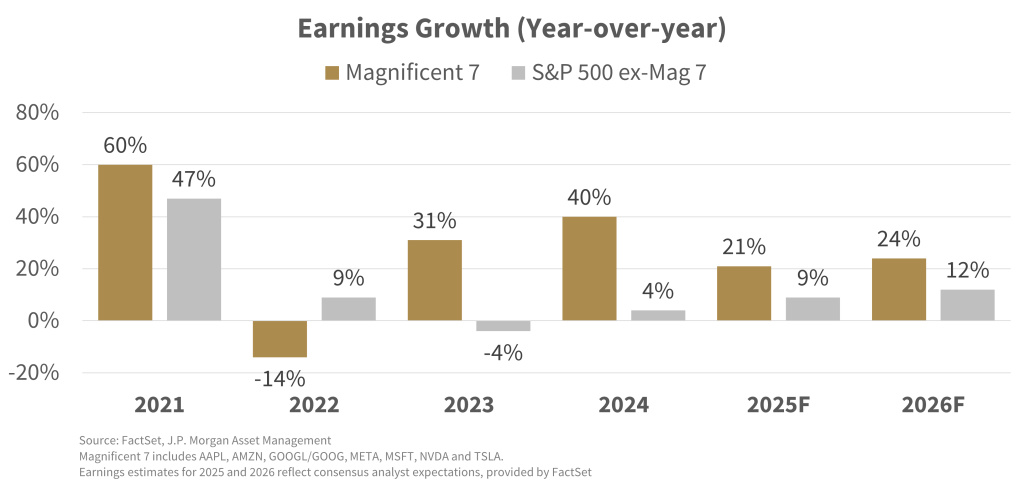

In the United States, these strong returns matched the strong earnings growth produced by American companies alongside almost record profit margins. The Magnificent 7 tech stocks again led the charge in markets, rising 23% versus 13% for the S&P 493 in price terms, supported by 21% earnings growth (vs. 9% for the rest). International markets mirrored this trend, with semiconductor and AI-related companies as top contributors.

AI’s momentum also remained relentless. Alphabet’s Gemini 3 launch in November reaffirmed scaling laws (increases in data, compute, reinforcement learning and test time lead to improved AI performance) and boosted confidence after fears of slowing progress. Despite high year-over-year earnings growth, valuations expanded further, making US technology companies and US companies broadly even more expensive. At year-end, the S&P 500 traded at 22x its forward 12-month earnings, quite a bit more expensive than the 30-year average of 17.1x. Big Tech’s multiples clearly depend on future AI monetization – a promising path but not without risks.

The Uncertain Future for AI in 2026

While optimistic valuations could face a correction if AI research stalls and scaling laws fail, we view this as unlikely given the scaling laws historical reliability and the capital being invested in the space. Elon Musk’s AI start-up, xAI, is expected to be the first to train new models on Nvidia’s most advanced Blackwell chips, and, if scaling laws hold, we expect a jump in intelligence and efficiency in frontier models in the first quarter of 2026.

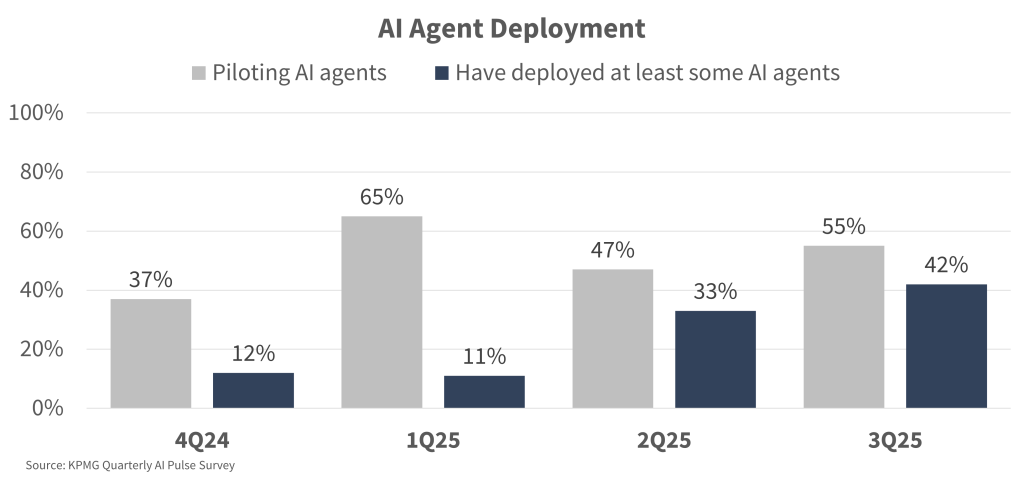

Autonomous agents, often referred to as “agentic AI,” are emerging as the next frontier in artificial intelligence. These systems use multi-step reasoning and a coordinated set of AI tools to autonomously and reliably complete employee workflows. As models become smarter, they can support a wider set of workflows with higher reliability, while growing compute capacity drives down costs and enables more ubiquitous agent deployment. Each new datacenter might support millions of these agents as they begin automating workflows across corporate America. We believe these AI agents will be the “killer app” of artificial intelligence and in many ways are already reshaping productivity across corporate America. A recent MIT simulation (Project Iceberg) tracking 151 million US workers across 32,000 skills and 923 occupations found that AI can technically replace 11.7% of the American workforce today, affecting $1.2 trillion in wages. We expect to see additional corporate earnings on the back of margin expansion as companies leverage these AI tools to reduce labor costs. In a recent survey of CEOs taken by Yale’s School of Management, 66% of leaders surveyed said they planned to either reduce headcount or maintain the size of their teams in 2026. Only 1/3 said they plan to increase headcount.

We remain committed to technology exposure, believing AI’s long-term earnings potential outweighs near-term volatility; however, we are becoming increasingly more selective in how we get that exposure.

Growing Wealth and Income Inequality and Washington’s Response

If AI continues to deliver, and we expect this as the most probable outcome, we also expect wealth and income inequality to continue to grow in tandem. Thomas Piketty argued in his 2013 book Capital in the Twenty-First Century that economic inequality tends to increase through generations primarily because capital grows faster than labor. While there is some debate about how true this was throughout history, most agree that the argument holds up well in the age of AI. In a world of advanced robotics and AI, artificial intelligence will increasingly render capital a true substitute for labor. Without labor-related adverse shocks to capital, the likely result will be higher returns on capital – with the benefit accruing principally to those that have the most of it.

These two tail risks for AI (a correction if AI falters on the one hand and increased inequality if it succeeds on the other) produce a potentially challenging environment for the current administration headed into the midterms in November. “Affordability” will continue to be the political buzzword in 2026, and we believe this dynamic will push the administration toward increasingly populist policies ahead of midterms – likely involving both deficit spending and increased pressure on the Fed to cut rates. Both would exacerbate an already imbalanced US fiscal situation that could someday trigger material problems for markets. With a national debt in the US over $38 trillion and $1.2 trillion in annual interest payments, this debt will need to be solved eventually through some combination of real growth in the economy, increased revenue (higher taxes), austerity or inflation.

Jerome Powell’s term as Federal Reserve Chair is set to end in May with major potential implications for the institution as a new leader takes the helm. Whomever is picked, their expected to be supportive of the President’s call for lower interest rates. While this is generally supportive to equity markets, we will have to watch and see how both the bond market and inflation react to these moves. The Federal Reserve sets the overnight interest rate, but longer-term rates are a function of both current short-term rates and longer-term expectations for inflation. The Federal Reserve cannot directly control the latter, and our expectation for 2026 is a steepening of the yield curve. As the Fed brings rates lower, we expect the longer end of the curve to move higher, reflecting future inflation fears.

Global Markets and the US Dollar

A substantial move in markets that we did not see coming was the sharp decline in the US dollar in the first quarter of 2025, which provided a tailwind for international market performance as measured in US dollars. Last year, we wrote that “owning the broad EAFE index is not appealing.” Yet, the EAFE index returned an impressive 31.9% in USD, outpacing the S&P 500’s 17.9%.

However, a closer look might put this performance in perspective. This outperformance was concentrated in the first quarter and driven almost entirely by currency conversion: 87% of the relative performance between the two indices for the year came from currency effects rather than underlying fundamentals. If we measure the EAFE’s performance in local currency terms, the performance drops to 21.2%. The remaining difference (and then some) came from multiple expansion rather than earnings growth, meaning that despite the performance differences, the US market still outperformed the international market in the truest fundamental metric: earnings growth.

Additionally, the two major themes that drove international performance were European aerospace and defense companies as well as Taiwan technology companies. European aerospace and defense names were boosted by commitments in Europe to rebuild its defense infrastructure as war knocked on its front door in Ukraine. Taiwan technology was dominated by the semiconductor powerhouse Taiwan Semiconductor, a company with a near monopoly on producing the most advanced artificial intelligence chips.

Outlook for International Developed Markets

While European defense companies saw a resurgence in sentiment in 2025, Europe faces deep fiscal challenges, as it attempts to re-arm amid geopolitical tensions and reduced US global policing. While a level of political will exists, funding defense will require tax increases or cuts to social programs given that many European nations already face skeptical credit markets for their debt. It is not clear that there is a path through – tax increases will stifle economies and drive away business owners; social program cuts will immediately be met by strikes, road blockages and social unrest. For us, this goes into the “too hard” pile – a situation that has too many variables outside anyone’s control for us to reasonably assess the likely outcome.

As we turn to Taiwan, despite its semiconductor dominance, the country remains under high alert from a threat from China. War games as recent as mere weeks ago around Taiwan underscore the risk of escalation, reminding investors that geopolitical risk is not theoretical – it is real and persistent. While we were comfortable with this risk in 2025 (and both our international ETF and Spinnaker Select portfolios benefitted from Taiwan semiconductor’s strong performance), we must evaluate whether the risk has changed in light of United States action in Venezuela. In addition, the success of China’s own efforts to develop advanced chips will play a large role in determining how urgent it is for China to gain access to Taiwan’s technology – one way or another. Our base case is that China will continue to play a longer game with Taiwan, hoping to eventually annex it similar to Hong Kong, but we will watch this closely in 2026.

As we enter 2026, we encourage our clients to remain fully invested according to the asset allocation strategies they have developed with their client advisors. Those allocations favor US equities, and we believe that remains appropriate. One year ago, we stated that the technology revolution was real and that our clients needed to fully participate. That remains true, but the benefits of AI, which have largely been reflected in the shares of the Magnificent Seven to date, will likely be felt by a far-wider range of leading companies that are racing to employ AI to reduce costs and enhance their businesses. Like one year ago, there are a myriad of risks. The Trump administration is unpredictable and is willing to take bold actions. With a challenging midterm election coming, populist policies that are adverse to businesses are certainly possible. Geopolitical risks and opportunities are at extraordinarily high levels, and within the USA, bitter partisanship is evident at all levels of government, making bipartisan action less likely. We are grateful for our clients’ confidence and will remain watchful as these extraordinary times unfold.

Keeping You Up-to-Date

More News

-

January 2026

After a turbulent start marked by tariff concerns following Liberation Day, 2025 delivered robust gains across financial markets.

-

Are We In An AI Bubble?

AI is powering market gains, but are valuations too high? Our investment team explores the risks, realities, and long-term potential of this transformative trend.